Since our doors opened in 1898 in England, Arkansas, Bank of England has been providing down home exceptional service. Along with powerful nationwide mortgage loans, we offer clients peace of mind knowing they are working with a credible national mortgage banker. Our success is due primarily to the talent of our people and access to hundreds of mortgage products at our industry's best pricing. Our management team has a combined 150 years of mortgage experience and is actively involved as members and board members on local, state and national mortgage broker and banker associations.

Building on that foundation, we have grown to a company of more than 1000 employees with branches in over 45 states. We have 141 locations nationwide to serve your mortgage needs.

Because we know the community, we are able to provide a well-rounded review of a loan application.

We do not just rubber stamp the decisions that an impersonal automated underwriting system produces, and that many lenders use as the sole criteria for a lending decision. Our loan officers take the time to understand the needs of the applicant and provide them with the best options possible.

Because we know the community, we are able to provide a well-rounded review of a loan application.

We do not just rubber stamp the decisions that an impersonal automated underwriting system produces, and that many lenders use as the sole criteria for a lending decision. Our loan officers take the time to understand the needs of the applicant and provide them with the best options possible.

We take pride in our excellent staff, superior operations, and devotion to customer service. We will not stop until we have exceeded our clients' expectations. We look forward to that opportunity.

Bank of England Mortgage is dedicated to working with clients to help find the right home loan, or refinancing option for them. Our loan specialists and our clients work together to identify the loan that best fits their needs and lifestyle. That's why we offer one of the most comprehensive selections of mortgage and refinance options on the market.

The combination of our excellent staff, superior operations, and devotion to customer service, means one thing to all of us at Bank of England Mortgage: We will not stop until we have exceeded our clients' expectations. We look forward to that opportunity.

We deliver outstanding products and the best service in the industry - that leaves us ahead of the competition in the eyes of borrowers. For instance, we provide competitive rates, the most knowledgeable, professional loan officers in the industry. Because of their expertise, they can qualify more borrowers, identify their needs, and ensure that each person buys the loan that is right for them and their family.

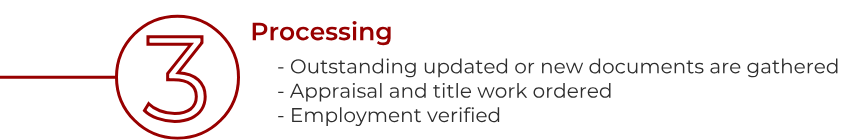

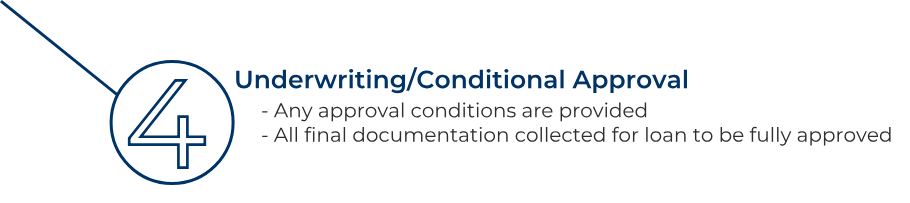

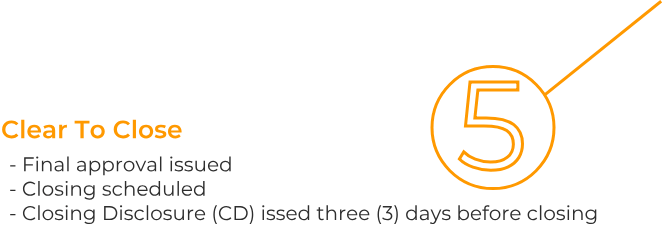

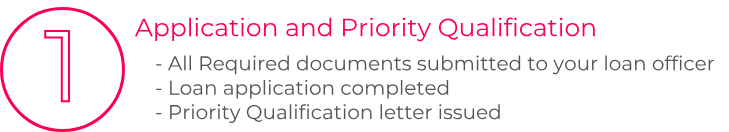

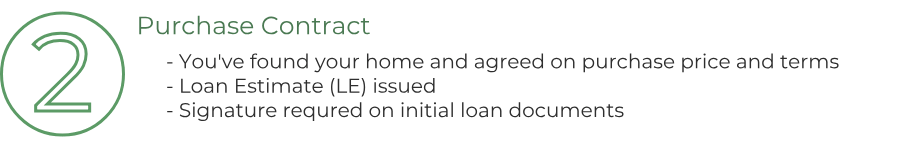

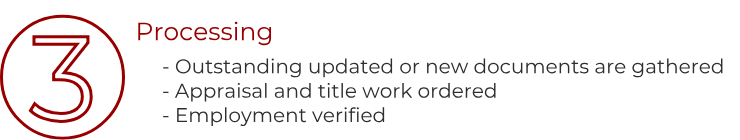

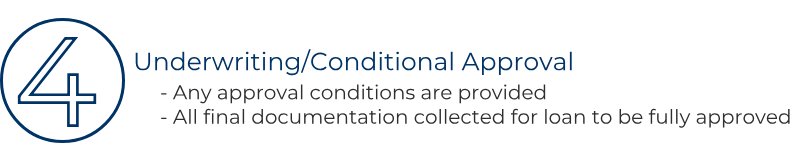

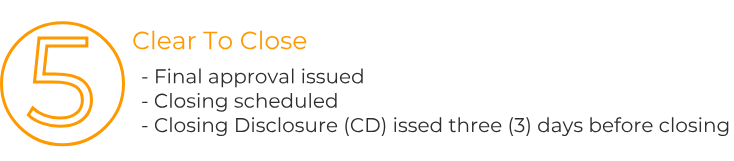

* Each mortgage is separate and unique. Some steps might differ based on your loan product and scenario

* Each mortgage is separate and unique. Some steps might differ based on your loan product and scenario

This was my first home purchase and Jodi helped me all throughout the process. He followed up quickly and helped me over come some issue during the loan process. All in all, it was a great experience working with Jodi.

I recently took a new job, which required us to relocate across the state. Naturally this meant trying to sell one house and while looking for another. These sorts of situations are always unique, but share some common elements: timing is never what you want, and there will be more stress than you need. Our situation was no different, and in our unique situation, we had to close on the new house in a very short timeframe. I contacted Jodi early on (a bit frazzled) and explained what was happening. He assured us that he could meet our highly aggressive timeline to obtain a home loan. Although we presented Jodi with a very, very tight timeframe, he was able to secure our loan in time for closing. Throughout the entire loan application process, Jodi kept us abreast of how things were going and what was coming up. Jodi made the process of getting a loan as low stress as could be possible. This was the second time Jodi helped us to get a loan. At some point in the future, when it's time to buy our retirement home, Jodi will be the first person I call.

The experience was very pleasurable and completed in a timely manner. Any questions that we had were answered right away and fully explained. I would highly recommend Bank of England.

Jodi did a great job, he answered questions as needed. He gave helpful advice for credit score. Overall the process was rather easy as far as home buying goes. Really the only reason I am rating as a 3 star instead of higher is based on the fact that Bank of England sold my loan to another company. And although this could be considered common in the industry. I don't particularly like my loan being sold to a company where i have no connections, and can't go talk to someone when I have any problems. Although this was later explained as common, it is likely the only reason I listed as somewhat likely to recommend to others. But overall Jodi was great to work with, and if you are not bothered by who ultimately holds your loan, then Jodi with Bank of England can be very helpful

Jodi was very helpful to us when we moved into the area and then again when we purchased a different house. He was always available to answer any questions we had or to give advice that would benefit us.

Jodi was great to work. I was a first time home buyer and he helped from the beginning with getting pre-approved, what types of loans I could go for, what to expect in the current market, and how I should put my offer in to win my house. So helpful during the whole process! Highly recommend!

I was referred to Jodi by an Agent that I did not end up buying from. Yet, I was so impressed with his help and willingness to serve a client, I came back when I found the home I eventually purchased. When I experienced what I thought was a traumatic event during the purchase, and my Loan Processor was out of town, Jodi when way above and beyond to solve the issue and put me at ease.

This was my first home purchase and Jodi helped me all throughout the process. He followed up quickly and helped me over come some issue during the loan process. All in all, it was a great experience working with Jodi."

Overall process just went quick and costed less than expected. Have referred and will continue to refer friends and family. Jodi and his associate Aaron were pleasant and really helped make the experience pleasant.

Please leave us a message with any questions